Temkin Group has just released the 2012

Every company makes mistakes now and then, but how willing are customers to forgive the company when it happens? Forgiveness is a valuable asset that companies earn by consistently meeting customers’ needs.

Every company makes mistakes now and then, but how willing are customers to forgive the company when it happens? Forgiveness is a valuable asset that companies earn by consistently meeting customers’ needs.

We introduced the Temkin Forgiveness Ratings last year to gauge which companies are earning this important element of loyalty. The 2012 Temkin Forgiveness Ratings include 206 companies from 18 industries and is based on a survey of 10,000 U.S. consumers.

We introduced the Temkin Forgiveness Ratings last year to gauge which companies are earning this important element of loyalty. The 2012 Temkin Forgiveness Ratings include 206 companies from 18 industries and is based on a survey of 10,000 U.S. consumers.

Congratulations to the top firms in this year’s ratings: USAA, Hyatt, credit unions, H.E.B., Hy-Vee, Dollar Rent A Car, Chick-fil-A, Publix, Costco, and Amazon.com. Of course, not every company enjoys such a high degree of forgiveness from their customers, especially the companies at the bottom of the 2012 ratings: Citigroup, Charter Communications, HSBC, Chrysler dealers, EarthLink, Bank of America, Comcast, Quest, and US Airways.

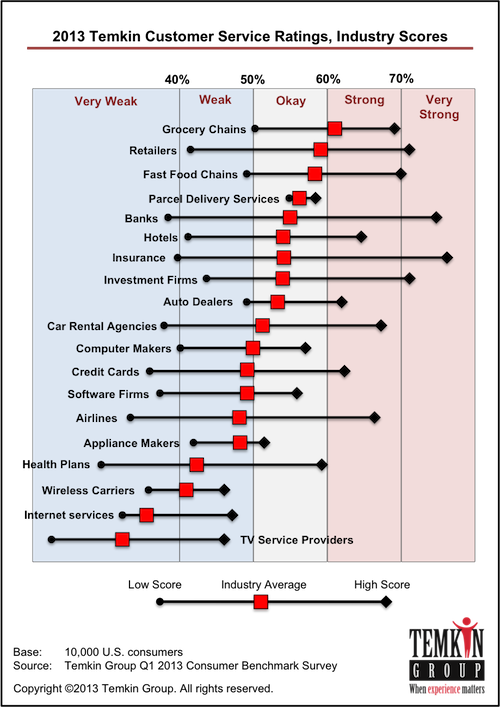

We also examined industry averages and found that grocery chains have earned the most forgiveness from consumers followed by retailers, appliance makers, and parcel delivery services. But consumers are not very likely to forgive mistakes by credit card issuers, Internet service providers, and TV service providers.

We also examined industry averages and found that grocery chains have earned the most forgiveness from consumers followed by retailers, appliance makers, and parcel delivery services. But consumers are not very likely to forgive mistakes by credit card issuers, Internet service providers, and TV service providers.

We examined how individual companies are rated relative to their industry peers. USAA holds the top two spots, outpacing its credit card and banking peers by more than 30 percentage points. USAA also outpaces the insurance industry by more than 20 percentage points. Credit unions, Hyatt, US Cellular, Dollar Rent A Car, Chick-fil-A, and Bright House Networks are also more than 15 percentage points above their industry averages. Five companies fall 15 or more percentage points below their industry’s average Temkin Forgiveness Ratings: Chrysler dealers, Citigroup, Travelers, Charter Communications, and RadioShack.

We examined how individual companies are rated relative to their industry peers. USAA holds the top two spots, outpacing its credit card and banking peers by more than 30 percentage points. USAA also outpaces the insurance industry by more than 20 percentage points. Credit unions, Hyatt, US Cellular, Dollar Rent A Car, Chick-fil-A, and Bright House Networks are also more than 15 percentage points above their industry averages. Five companies fall 15 or more percentage points below their industry’s average Temkin Forgiveness Ratings: Chrysler dealers, Citigroup, Travelers, Charter Communications, and RadioShack.

We also analyzed changes from the 2011 Temkin Forgiveness Ratings. The research shows that consumers are more forgiving this year than they were last year. Led by banks and insurance carriers, all 12 industries that were in both the 2011 and 2012 Temkin Forgiveness Ratings showed improvement.

Sixty-eight of the 139 companies that were in the 2011 and 2012 Temkin Forgiveness Ratings earned double-digit improvements and four companies improved by more than 25 percentage points: TD Ameritrade, Lenovo, USAA, and credit unions. Ten companies lost ground over the last year with the biggest drops coming for Citigroup, Continental Airlines, Travelers, Sears, Holiday Inn Express, and The Hartford.

Sixty-eight of the 139 companies that were in the 2011 and 2012 Temkin Forgiveness Ratings earned double-digit improvements and four companies improved by more than 25 percentage points: TD Ameritrade, Lenovo, USAA, and credit unions. Ten companies lost ground over the last year with the biggest drops coming for Citigroup, Continental Airlines, Travelers, Sears, Holiday Inn Express, and The Hartford.

Do you want to see the data? Go to the Temkin Ratings website where you can sort through all of the results for free. You can even purchase the underlying data if you want to get more access.

Do you want to see the data? Go to the Temkin Ratings website where you can sort through all of the results for free. You can even purchase the underlying data if you want to get more access.

The bottom line: To err is possible, to earn forgiveness is divine

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.