H-E-B and Trader Joe’s Earn Highest Emotion Ratings

December 1, 2014 Leave a comment

In a previous post, I defined the three elements of an experience: Success, Effort, and Emotion.

Emotion is a significant blind spot for most organizations. In the Temkin Group report State of CX Metrics, 2013, we found that only 11% of large companies feel that they do a very good job of measuring customers’ emotional responses. Our ROI of Customer Experience, 2014 shows that emotion is the most significant driver of loyalty, especially when it comes to consumers recommending firms to their friends.

We’ve been measuring emotion as part of our Temkin Experience Ratings for four years. Our emotion rating is based on asking consumers the following question:

Thinking of your most recent interactions with each of these companies, how did you feel about those interactions?

Responses range from 1 (upset) to 7 (delighted) and the emotion rating is calculated as the percentage of consumers who select 6 or 7 minus the percentage who select 1, 2, or 3.

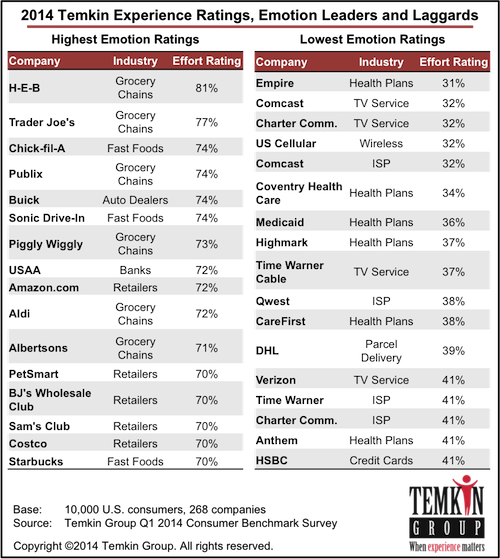

As you can see in the list of leaders and laggards below (from ratings of 268 companies across 19 industries based on a survey of 10,000 U.S. consumers), H-E-B earned the highest overall emotion rating of 84%, outpacing second place Trader Joe’s by three points.

At the other end of the spectrum, Empire BCBS earned the l0west rating of 31% and several companies were just slightly better with 32%: Comcast (Internet and TV service), Charter Communications, and US Cellular.

The bottom line: Stop ignoring how your customers feel.