Report: Employee Engagement Competency & Maturity, 2017

June 5, 2017 Leave a comment

We just published a Temkin Group report, Employee Engagement Competency & Maturity, 2017. Here’s the executive summary of this annual review of employee engagement activities, competencies, and maturity levels for large companies:

We just published a Temkin Group report, Employee Engagement Competency & Maturity, 2017. Here’s the executive summary of this annual review of employee engagement activities, competencies, and maturity levels for large companies:

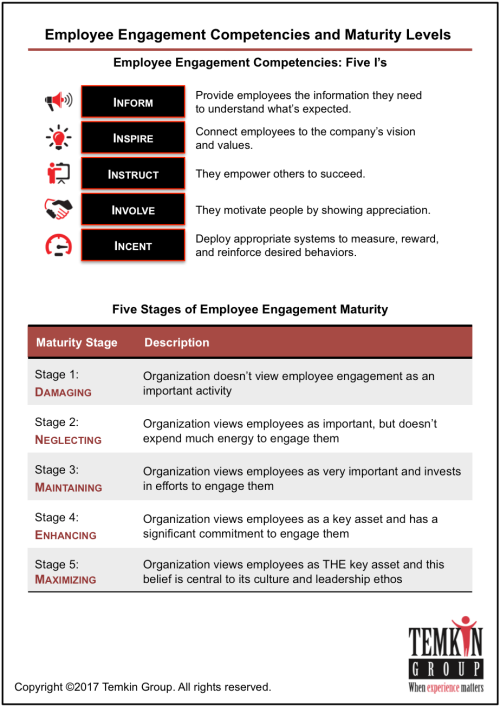

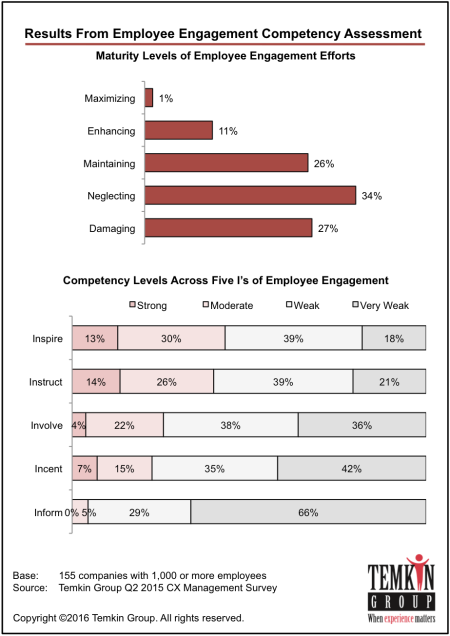

Engaged employees are critical assets to their organization. It’s not surprising, therefore, that customer experience leaders have more engaged employees than their peers. To understand how companies are engaging their employees, we surveyed 169 large companies and compared their responses with similar studies we’ve conducted in previous years. We also asked survey respondents to complete Temkin Group’s Employee Engagement Competency & Maturity (EECM) Assessment. Highlights from our analysis of their responses include:

- Front-line employees are viewed as the most highly engaged.

- More than 70% of companies measure employee engagement at least annually, yet only 45% of executives consider taking action on the results a high priority.

- Sixty-four percent of respondents believe that their social media tools have had a positive impact on their employee engagement activities, an increase from last year.

- The top obstacle to employee engagement activities continues to be the lack of an employee engagement strategy.

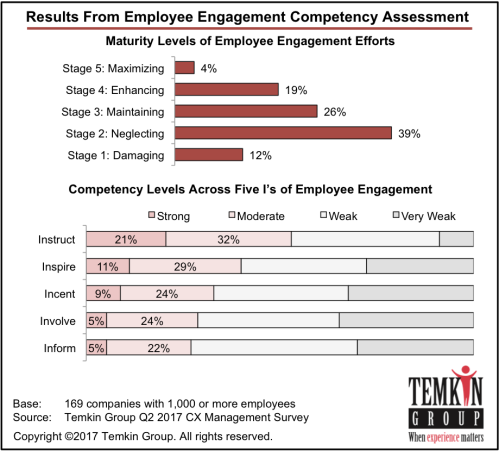

- While only 23% of companies are in the top two stages of employee engagement maturity, this is still an increase from last year.

- When we compared companies with above average employee engagement maturity to those with lower maturity, we found that employee engagement leaders have better customer experience, enjoy better financial results, are more likely to take action on employee feedback, and face fewer obstacles than their counterparts with less engaged workforces.

- You can use the results of the EECM Assessment to benchmark your own employee engagement activities.

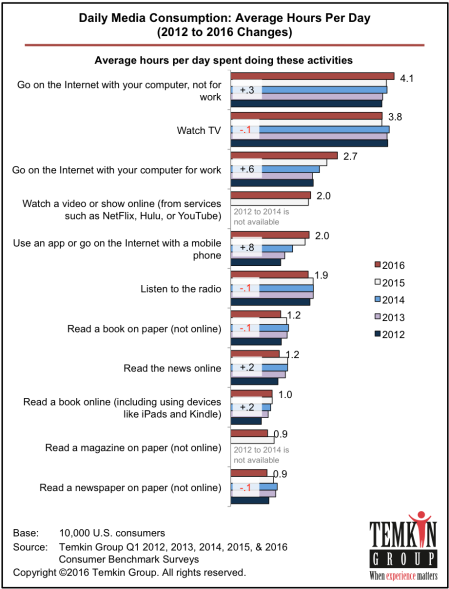

Here’s an excerpt from one of the 17 graphics that shows the maturity levels of employee engagement efforts in large companies and their effectiveness across five employee engagement competencies: