In case you missed it, (which would be nearly impossible if you read my blog, follow me on Twitter or receive the Temkin Group newsletter) yesterday was the first ever Customer Experience (CX) Day. It was a huge success as people around the world came together to “celebrate great customer experience and the people who make it happen.” The day started with a Google+ Hangout in Australia and ended with three in-person events on the U.S. west coast (part of the CXPA.org’s schedule of local events in 19 cities across 5 countries).

One of the highlights of my day was a webinar that I hosted with Dan Hesse, CEO of Sprint (which you can watch on the CXDay.org site). It turns out that we are both alumni of MIT Sloan School (a little plug for our alma mater). The webinar with Dan provided a great opportunity to hear Sprint’s inspirational CX story and offered a glimpse into the mind of a CEO who really “gets CX.” Dan’s efforts at Sprint highlight many elements of Temkin Group’s four customer experience core competencies.

Here are some of my takeaways from our discussion:

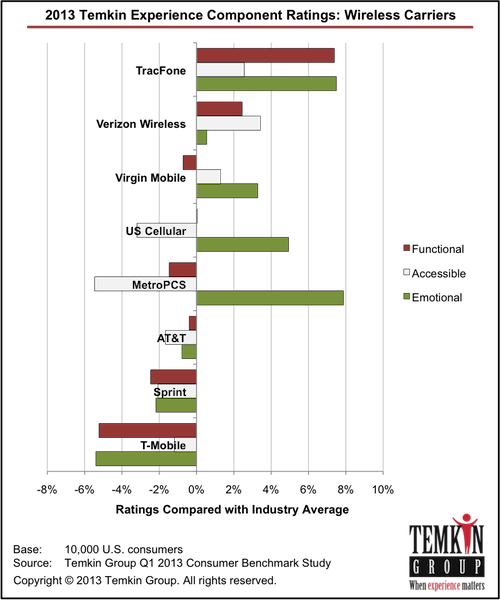

Sprint is a huge CX success. When Dan took over as CEO of Sprint in December of 2008, the company was on the brink of bankruptcy. Dan was able to quickly shift the organization given the looming bankruptcy, as he said, “Never waste a good crisis.” By focusing on customer experience, the company has not only rebuilt the company, but Sprint has been the most improved company across all companies in the American Customer Satisfaction Index over the previous five years.

Focus on clear, consistent priorities. Dan states, and often reiterated, that the company focuses on three objectives: Improve the customer experience, Strengthen the Brand, and Generate cash. These were the priorities that he set when he started as CEO and they remain Sprint’s focus today. Concentrating on a consistent set of priorities helps an organization stay aligned and heading in the same direction

Attack root causes, not veneers. Dan explained that Sprint had two parts of its business, network and service. Network was much more expensive and slow to change, so he instead focused on service. They mainly focused on calls into customer care, which was happening at a much higher rate than the industry average. I liked when he said, “You can’t just throw money at a broken system.” He didn’t see the calls as the problem, but rather as a symptom of other problems around the organization. So Sprint systematically attacked the issues that were causing customers to call into customer care.

Great CX is Free. That’s the name of the customer experience manifesto that I published years ago. It builds on the core principles that if you fix problems early on in the process, you can save money while improving the end product. It turns out that Dan shared my focus on total quality as a key enabler of CX success, as evidenced by the fact that Sprint improved CX in its contact centers while cutting its contact center costs in half.

Leaders have two levers. Dan clearly understood what he needed to do to drive change across the organization. He knew that, as CEO, he had two levers to use:

- Compensation. He tied he variable compensation of everyone in the company to the single key metric he was determined to improve, the number of calls into customer care.

- His agenda. Dan knew that the company would focus on the things that he asked about during his staff meetings, so his agenda consistently covered customer experience. He always asked, “Why are customers leaving?” Because his staff knew he would be asking about it, they consistently worked with their organization to prepare an answer, causing the concentration on CX to cascade across the organization.

Employees are key ingredient to success. Dan discussed a couple of Sprint’s efforts to engage employees in the process. The company has what it calls “Thank You Thursdays,” during when employees across the company take the time to write handwritten thank-you notes to customers (this was Tip #30 in my 50 CX Tips). In 2012, they wrote 500,000 of these notes. Dan also described a program called “Social Media Ninjas” where employees around the company volunteer to advocate for Sprint across social media channel. Sprint also has some other interesting employee engagement programs such as “Employees Helping Customers“ and “Employees Getting Customers,” that are worth reading about.

Retention trumps acquisition. I think the focus on customer acquisition, rather than customer retention, has played a huge role in of the lack of good customer experience across the entire telecom (and TV service) market. But when asked by an audience member about acquisition versus retention, Dan was clear about his priorities: Retention drives Sprint’s business because it drives word of mouth.

Predictive personalization in the future. When I asked Dan about what’s coming in the future, he discussed the need for companies to use the data that they have on customers to treat them each in a more customized way. He liked when I explained that his vision aligned with what we call Predictive Personalization, which is one of the eight future CX skills we’ve identified. He also discussed other trends for the future, such as “bricks & clicks” ominichannel and more self-service.

Simplicity is differentiating. When asked what accomplishment he was most proud of, Dan pointed to his integration of marketing and customer experience. He credits that connection with the creation of offerings like Sprint’s “Simply Everything.” As Dan said, “People will pay a premium for simplicity.” This led to a nice discussion on a key “hidden” benefit of simplification: repeatability and consistency.

The bottom line: Talking with Dan was a great way to celebrate CX Day

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.