Report: What Happens After a Good or Bad Experience, 2017

May 8, 2017 2 Comments

We just published a Temkin Group report, What Happens After a Good or Bad Experience, 2017. This is our annual analysis of which companies deliver the most and least bad experiences, how consumers respond after those experience (in terms of sharing those experiences and changing their purchase behaviors), and the effect of service recovery (see last year’s report).

We just published a Temkin Group report, What Happens After a Good or Bad Experience, 2017. This is our annual analysis of which companies deliver the most and least bad experiences, how consumers respond after those experience (in terms of sharing those experiences and changing their purchase behaviors), and the effect of service recovery (see last year’s report).

Here’s the executive summary:

To understand how good and bad experiences effect customer behavior, we asked 10,000 U.S. consumers about their recent interactions with more than 300 companies across 20 industries. We then compared results with similar studies we’ve conducted over the previous six years. Here are some highlights:

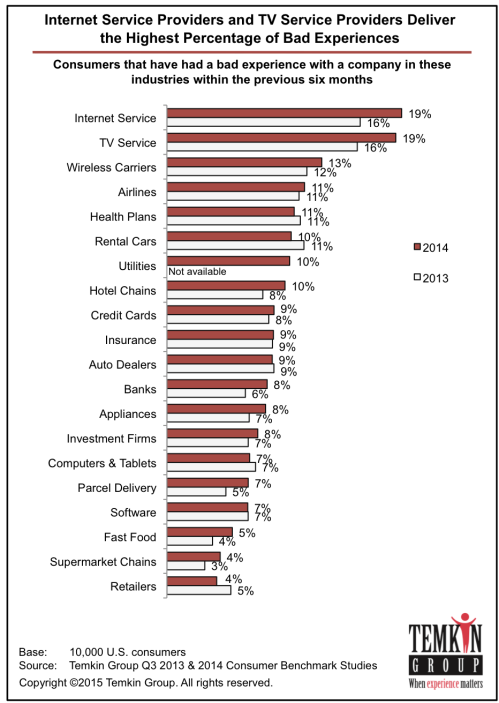

- About 19% of the customers who interacted with Internet service providers and TV service providers reported having a bad experience – a considerably higher percentage than in other industries. Of the companies we evaluated, 21st Century, Spirit Airlines, and HSBC deliver bad experiences most frequently.

- We looked at the percentage of customers in an industry had a bad experience and combined that number with the percentage of customers who said they decreased their spending after a bad experience and then used this data to create a Revenues at Risk Index for all 20 industries. Rental car agencies stand to lose the most revenue (6.7%) from delivering bad experiences, while retailers stand to lose the least (1%).

- Investment firms are most effective at recovering after a bad experience, whereas TV service providers are the least effective.

- After customers have a very bad or very good experience with a company, they are more likely to give feedback directly to the company than they are to post about it on Facebook, Twitter, or third party rating sites. Customers are also more likely to share positive feedback through online surveys and share negative feedback through emails.

- Compared to previous years, customers are more likely to share feedback over Facebook and Twitter, and these channels are most popular with consumers who are between 25- and 44-years-old.

- Of all the companies we evaluated, The Hartford is the most likely to receive negatively biased feedback directly from its customers, while Chubb is likely to receive the most positively biased feedback.

Here are excerpted versions of 3 (out of 19) graphics in the report:

Read more of this post