We recently released the 2016 Temkin Experience Ratings that ranks the customer experience of 294 companies across 20 industries based on a survey of 10,000 U.S. consumers.

Credit unions, USAA, and Regions deliver the best customer experience in the banking industry, according to the 2016 Temkin Experience Ratings, an annual customer experience ranking of companies based on a survey of 10,000 U.S. consumers.

Credit unions took the top spot in the banking industry for the fifth year in a row, earning a rating of 77% and placing 7th overall out of 294 companies across 20 industries. USAA and Regions tied for second place, each receiving a rating of 75% and an overall rank of 12th. Three other banks earned “good” ratings (above 70%): Capital One 360, TD Bank, and PNC.

Meanwhile at the bottom of the list, Citibank has the lowest score of out of 15 banks in the ratings (56%), and it placed 190th overall. Citizens was not far ahead as it received a 60% rating and came in 153rd place overall.

Of the 15 banks we looked at, not a single one improved its rating over the past year. Citizens dropped the most, falling 12 points between 2015 and 2016.

Overall, the banking industry averaged a 67% rating in the 2016 Temkin Experience Ratings and tied for 4th place out of 20 industries. The average rating of the industry decreased by four percentage points between 2015 and 2016, dropping from 71% to 67%.

Here are some additional findings from the banking industry: Read more of this post

Filed under 2016 Temkin Ratings, Customer experience

Tagged with bank, Bank Of America, banking, Capital One, Capital One 360, Chase, Citibank, Citizens, credit unions, Fifth Third, PNC, Regions, SunTrust Bank, TD Bank, U.S. Bank, USAA, Wells Fargo

We recently released the 2015 Temkin Experience Ratings that ranks the customer experience of 293 companies across 20 industries based on a survey of 10,000 U.S. consumers.

USAA and credit unions tied for the top spot, each with a rating of 81%, putting them in 8th place overall out of 293 companies across 20 industries. Credit unions (which is a rating for a group of credit unions, not one company) have earned the highest ranking for banks over the past four years. USAA has been hovering around the top of the banking list since 2011, but this is the first year that it actually took the top spot.

Meanwhile, BB&T debuted on the Ratings at the bottom of the industry, with a rating of 61% and a rank of 199th overall. Citibank was not far ahead, receiving a rating of 62% and coming in 187th place overall.

Here are some highlights from the banking industry:

- Overall, the banking industry averaged a 71% rating in the 2015 Temkin Experience Ratings and placed 5th out of 20 industries. The average rating of the banking industry stayed steady at 71% between 2014 and 2015.

- The ratings of all banks in the 2015 Temkin Experience Ratings are as follows: USAA (81%), A credit union (81%), Regions (78%), SunTrust Bank (73%), PNC (73%), Chase (73%), Citizens (73%), TD Bank (72%), S. Bank (72%), Capital One 360 (72%), Bank of America (67%), Capital One (67%), Wells Fargo (66%), Fifth Third (66%), Citibank (62%), and BB&T (61%).

- Citizens (+6 points), Fifth Third (+6 points), and Bank of America (+4 points) improved their ratings the most between 2014 and 2015.

- TD Bank (-8 points), Wells Fargo (-5 points), and Regions (-3 points) declined by the most percentage-points between 2014 and 2015.

Read more of this post

Filed under 2015 Temkin Ratings, Customer experience

Tagged with Bank Of America, BB&T, Capital One, Capital One 360, Chase, Citibank, Citizens, credit unions, Fifth Third, PNC, Regions, SunTrust Bank, TD Bank, U.S. Bank, USAA, Wells Fargo

In a previous post, I defined the three elements of an experience: Success, Effort, and Emotion.

Emotion is a significant blind spot for most organizations. In the Temkin Group report State of CX Metrics, 2013, we found that only 11% of large companies feel that they do a very good job of measuring customers’ emotional responses. Our ROI of Customer Experience, 2014 shows that emotion is the most significant driver of loyalty, especially when it comes to consumers recommending firms to their friends.

We’ve been measuring emotion as part of our Temkin Experience Ratings for four years. Our emotion rating is based on asking consumers the following question:

Thinking of your most recent interactions with each of these companies, how did you feel about those interactions?

Responses range from 1 (upset) to 7 (delighted) and the emotion rating is calculated as the percentage of consumers who select 6 or 7 minus the percentage who select 1, 2, or 3.

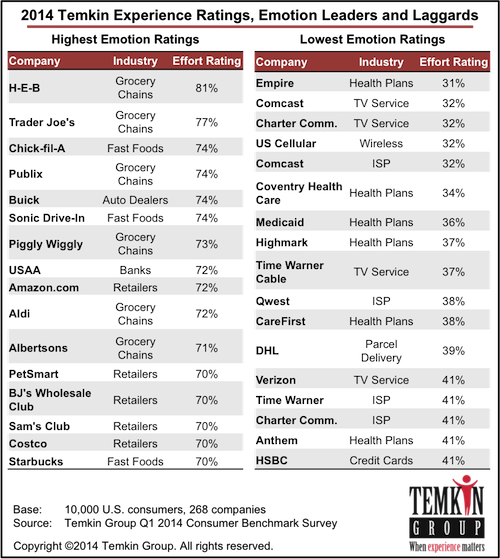

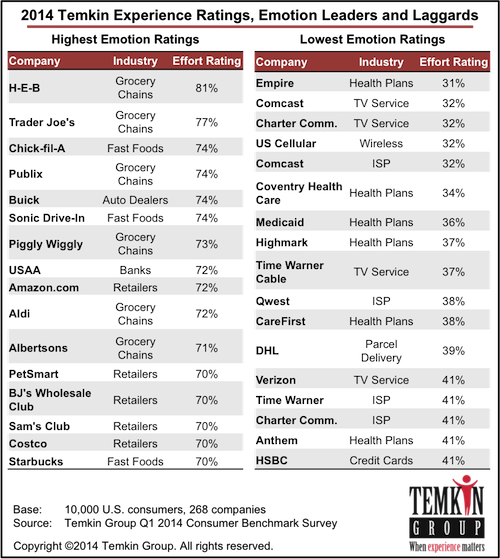

As you can see in the list of leaders and laggards below (from ratings of 268 companies across 19 industries based on a survey of 10,000 U.S. consumers), H-E-B earned the highest overall emotion rating of 84%, outpacing second place Trader Joe’s by three points.

At the other end of the spectrum, Empire BCBS earned the l0west rating of 31% and several companies were just slightly better with 32%: Comcast (Internet and TV service), Charter Communications, and US Cellular.

The bottom line: Stop ignoring how your customers feel.

Filed under Customer experience, Emotion

Tagged with BCBS, Burger King, Chick-fil-A, Chrysler, Comcast, Coventry Health Care, credit unions, Dairy Queen, Empire, Food Lion, H.E.B, Haier, Highmark, Hitachi, Kroger, Little Caesar's, Medicaid, Motel 6, Piggly Wiggly, Publix, Regions, Residence Inn, Sonic Drive-In, Starbucks, Super 8, Trader Joe's, US Airways

We just published a Temkin Group report, What Happens After a Good or Bad Experience, 2014. The report, which includes 19 data charts, examines which companies and industries provide the most bad experiences, what impact those experiences have on spending, and how the negative impacts of bad experiences can be mitigated by good service recovery. The report also examines how consumers share their good and bad experiences with companies as well as with other people. Here’s the executive summary:

We just published a Temkin Group report, What Happens After a Good or Bad Experience, 2014. The report, which includes 19 data charts, examines which companies and industries provide the most bad experiences, what impact those experiences have on spending, and how the negative impacts of bad experiences can be mitigated by good service recovery. The report also examines how consumers share their good and bad experiences with companies as well as with other people. Here’s the executive summary:

To understand the effect of good and bad experiences, we asked 10,000 U.S. consumers about their recent interactions with 268 companies across 19 industries. Results show that Internet services and TV services are the industries most likely to deliver a bad experience to their customers, while grocery chains are the least likely to. At the company level, Scottrade had the smallest percentage of customers reporting a recent bad experience with the company and Time Warner Cable had the highest. More than half of the customers who encountered a bad experience at a fast food chain, credit card issuer, grocery store, or hotel either decreased their spending with the company or stopped altogether. However, our data shows that a good service recovery effort can help mitigate a bad experience. Unfortunately, many firms—especially in the banking, Internet services, and TV services sectors—aren’t very good at service recovery. In addition to the consequences of bad interactions, we also examined which channels customers use to share their good and bad experiences and how these changed across age groups. We then compared these results to survey responses from the past two years. We also uncovered a negative bias inherent in how customers provide feedback. ING Direct, Residence Inn, and Fairfield Inn have the most negative bias in the feedback they receive directly from customers, while Hy-Vee and Hyundai have the most negative bias on Facebook.

Click link to see full list of industries and companies covered in this report (.pdf).

Download report for $195

One of the most interesting analyses in the report is the look at how service recovery after a bad experience affects the spending pattern of consumers. Here’s a summary of one of the charts showing just how important it is for a company to recover well after making a mistake:

Here are some other insights from the research:

- Sixteen percent of consumers who have interacted with TV service and Internet service providers report having a bad experience over the previous six months. Next on the list are wireless carriers, with 12% of their customers reporting a bad experience. At the other end of the spectrum, only 3% of consumers report a bad experience with grocery chains and 4% report having a bad experience with fast food chains.

- The five companies with the most customers reporting bad experiences are Time Warner Cable (25%), Motel 6 (22%), Coventry Health Care (21%), and Comcast (21%). There were 10 companies with only 1% or less of their customers reporting bad experiences: Scottrade, Chick-fil-A, H.E.B., Whole Foods, ShopRite, ING Direct, Starbucks, Trader Joe’s, Vanguard, and True Value.

- More than one-quarter of consumers who have a bad experience stop spending with computer makers, car rental agencies, credit card issuers, hotel chains, and software companies. The impact of bad experiences is less costly for parcel delivery services, wireless carriers, health plans, TV service providers, Internet service providers, and grocery chains, as less than 15% of their customers with bad experience stopped spending.

- The industries that are the best at responding to a bad experience are investment firms, major appliances, retailers, and car rental agencies. The industries that are the worst at responding to a bad experience are TV service providers, wireless carriers, Internet service providers, parcel delivery services, and health plans.

- Thirty-two percent of consumers give feedback directly to companies after a very bad experience and 23% give feedback after a very good experience.

- Overall, 25- to 34-year-olds are the most likely to share feedback about their experiences. After a good experience 57% tell a friend directly, 28% share on Facebook, and 18% put a comment or rating on a review site. After a bad experience, 60% tell a friend directly, 31% share on Facebook, and 20% write a review.

Download report for $195

The bottom line: Make sure to recover quickly after a bad experience

Filed under Benchmarks, Bruce Temkin Research, Customer Connectedness, Customer experience, Temkin Group Research, Trends

Tagged with 21st Century, 7-Eleven, A&P, AAA, Ace Hardware, Acer, Activision, Adobe, Advance Auto Parts, Aetna, AIG, AirTran Airways, ALamo, Alaska Airlines, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Ameriprise Financial, Anthem, AOL, Apple, Arby's, AT&T, Audi, AutoZone, Avis, Bank Of America, Barclaycard, Barnes & Noble, Baskin Robbins, Bed Bath & Beyond, Best Buy, Best Western, BJs Wholesale Club, Blackboard, Blue Shield of California, BMW, Bosch, Bright House, Budget, Buick, Burger King, Cablevision, Cadillac, Capital One, CareFirst, Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, credit unions, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta, DHL, DirecTV, Discover, Dish Network, Dodge, Dollar, Dollar General, Dollar Tree, Domino's, Dunkin' Donuts, E*Trade, eBay, Edward Jones, Electrolux, eMachines, Empire, Enterprise, Fairfield Inn, Family Dollar, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Foot Locker, Ford, Fujitsu, GameStop, Gap, Gateway, GE, Geico, Giant Eagle, GM, Google, H.E.B, Haier, Hampton Inn, Hardees, Health Net, Hertz, Hewlett-Packard, Highmark, Hilton, Hitachi, Holiday Inn, Holiday Inn Express, Home Depot, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JCPenney, Jeep, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kmart, Kohl's, Kroger, La Quinta Inn, Lenovo, Lexus, LG, Liberty Mutual, Little Caesar's, Lowe's, Macy's, Marriott, Marshalls, Mazda, McAfee, McDonalds, Medicaid, Medicare, Mercedes Benz, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN, National, Nationwide, New York Life, Nissan, Nordstrom, O'Reilly Auto Parts, Office Depot, OfficeMax, Old Navy, Optimum (iO)/Cablevision, Orange Julius, PetSmart, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quality Inn, Quiznos, QVC, Qwest, RadioShack, Regions, Residence Inn, Rite Aid, Ross, Safeway, Sam's Club, Samsung, Save-a-Lot, Scottrade, Sears, Sheraton, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Staples, Starbucks, State Farm, Stop & Shop, Subway, SunTrust Bank, Super 8, Symantec, T-Mobile, T.J. Maxx, Taco Bell, Target, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toyota, Toys "R" Us, TracFone, Trader Joe's, Travelers, TriCare, True Value, U.S. Bank, United Airlines, United Healthcare, UPS, US Airways, US Cellular, US Postal Service, USAA, Vanguard, Verizon, Verizon Wireless, Virgin Mobile, Volkswagen, Wal-Mart, Walgreens, Wells Fargo, Wendy's, Westin, Whirlpool, Whole Foods, Winn-Dixie

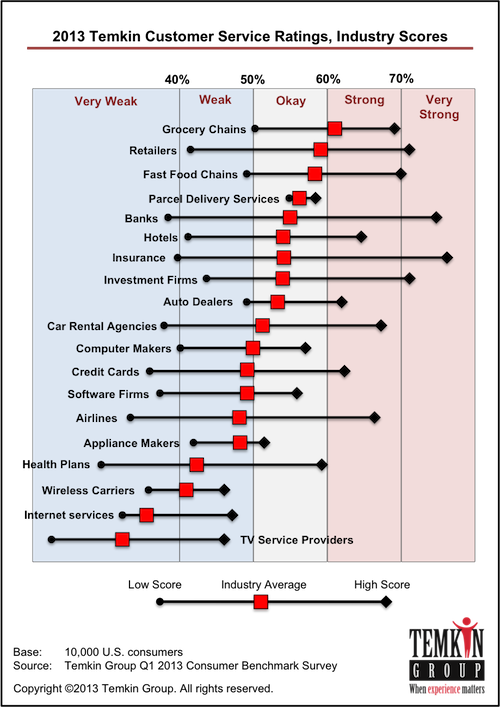

We just released the third annual Temkin Customer Service Ratings of 235 companies across 19 industries based on a study of 10,000 U.S. consumers (see full list of firms).

Download entire dataset for $295

Company Results

Here are some company highlights:

- USAA earned the top two spots for its insurance and banking businesses. Other companies at the top of the ratings are credit unions, Ace Hardware, Charles Schwab, Dollar Tree, Chick-fil-A, Sonic Drive-In, Hy-Vee, Costco, Trader Joe’s, Advantage, Publix, and H.E.B.

- TV service providers and Internet service providers earned nine out of bottom 10 spots in the ratings.

- For the second straight year, Charter Communications took the bottom spot. The rest of the firms in the bottom five are Time Warner Cable, Cox Communications, Optimum (i/o), and CareFirst.

- The following companies earned ratings that were 15 or more points above their industry averages: USAA (insurance and banking), Alaska Airlines, credit unions, Advantage, Kaiser Permanente, TriCare, Charles Schwab, and Bright House Networks.

- Five companies earned ratings that were 15 or more points below their industry averages: Apple Stores, US Airways, RadioShack, HSBC, and 21st Century.

- Twenty-three percent of companies earned “strong” or “very strong” ratings, while 37% earned “weak” or “very weak” ratings.

Temkin Group also examined year-over-year results for the 171 companies that were in both the 2012 and 2013 Temkin Customer Service Ratings and found that:

- Forty-four percent of companies improved their ratings while 47% experienced a decline.

- Twenty companies showed double-digit increases, led by: Citibank (banking and credit cards), U.S. Bank, Hyundai, Nissan, Old Navy, Charles Schwab, Continental Airlines, and Piggly-Wiggly.

- Eleven companies showed double-digit decreases, led by: LG, Giant Eagle, Toshiba, Cox Communications, ING Direct, and Budget.

Industry Results

Here are some industry highlights:

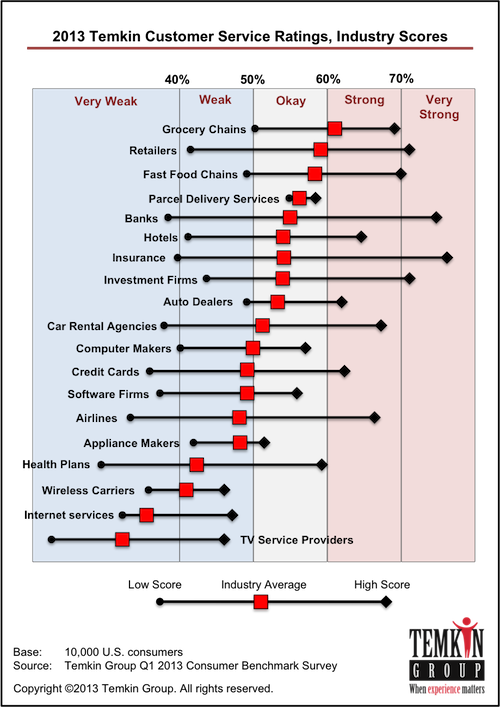

- Grocery chains, retailers, and fast food chains earned the highest average Temkin Customer Service Ratings, while TV service providers, Internet service providers, wireless carriers, and health plans earned the lowest ratings.

- On average, credit card issuers, banks and fast food restaurants improved the most while appliance makers, TV service providers and investment firms declined the most.

Calculating the Temkin Customer Service Ratings

During January 2013, Temkin Group asked 10,000 U.S. consumers to identify the companies that they had interacted with on their websites during the previous 60 days. These consumers were asked the following question:

Thinking back to your most recent customer service interaction with these companies,

how satisfied were you with the experience?

Responses from 1= “very dissatisfied” to 7= “very satisfied”

For all companies with 100 or more consumer responses, we calculated the “net satisfaction” score. The Temkin Customer Service Ratings are calculated by taking the percentage of consumers that selected either “6” or “7” and subtracting the percentage of consumers that selected either “1,” “2,” or “3.”

Download entire dataset for $295

To see all of the companies in the Temkin Customer Service Ratings as ell as all of our other Temkin Ratings and sort through the results, visit the Temkin Ratings website

The bottom line: TV service providers deliver terrible customer service

Filed under 2013 Temkin Ratings, Customer experience, customer service

Tagged with 21st Century, 7-Eleven, A credit union, AAA, Ace Hardware, Acer, Activision, Adobe, Advance Auto Parts, Advantage, Aetna, AirTran Airways, ALamo, Alaska Airlines, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Ameriprise Financial, Anthem (BCBS), AOL, Apple, Apple Store, Arby's, AT&T, AutoZone, Avis, Bank Of America, Barnes & Noble, Bed Bath & Beyond, Best Buy, Best Western, BJs Wholesale Club, Blackboard, Blue Shield of California, BMW, Bosch, bright House Networks, Budget, Burger King, Cablevision, Capital One, CareFirst (BCBS), Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Continental Airlines, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta / Northwest Airlines, DirecTV, Discover, Dish Network / EchoStar, Dodge, Dollar, Dollar General, Domino's, Dunkin' Donuts, E*Trade, Earthlink, Edward Jones, Electrolux, eMachines, Empire BCBS, Enterprise, Fairfield Inn, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Ford, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Health Net, Hertz, Hewlett-Packard, Highmark BCBS, Hilton, Holiday Inn, Holiday Inn Express, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kroger, La Quinta, Lenovo, LG, Liberty Mutual, Little Caesar's, Marriott, McAfee, McDonalds, Med, Medicaid, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN (Microsoft Network), Nationwide, Nissan, Optimum (iO) / Cablevision, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quiznos, Qwest, Regions, Road Runner, S, Safeway, Samsung, Save-a-Lot, Scottrade, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Starbucks, State Farm, Stop & Shop, SunTrust Bank, Symantec, T-Mobile, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toyota, TracFone, Trader Joe's, Travelers, U.S. Bank, U.S. Cellular, U.S. Postal Service, United Airlines, UPS, US Airways, USAA, Verizon, Verizon Wireless, Virgin Mobile, Wells Fargo, Whirlpool, Whole Foods, Winn-Dixie

We just released the third annual Temkin Web Experience Ratings of 211 companies across 19 industries based on a study of 10,000 U.S. consumers (see full list of firms).

Download entire dataset for $295

Company Results

Here are some company highlights:

- For the third straight year, Amazon.com topped the Temkin Web Experience Ratings while USAA took the next two spots for its bank and insurance businesses.

- Other companies at the top of the ratings are Regions, U.S. Bank, eBay, Advantage Rent A Car, credit unions, and QVC.

- At the other end of the spectrum, MSN, Health Net, EarthLink, and Cablevision earned the lowest ratings.

- Only 6% of companies earned “strong” or “very strong” ratings, while 63% earned “weak” or “very weak” ratings.

- Amazon.com and USAA’s insurance business earned ratings that were 20 points above their industry averages and eight other companies were at least 10 points above their peers: Kaiser Permanente, Advantage Rent A Car, eBay, QVC, USAA (bank), Sonic Drive-In, Charles Schwab, and Fidelity Investments.

- Health Net and RadioShack earned ratings that were 20 points or more less than their industry averages and six other companies were at least 15 points below their peers: 21st Century, American Family, Days Inn, Taco Bell, and Kmart.

Temkin Group examined year-over-year results for the 154 companies that were in the 2012 and 2013 ratings and found that:

- Forty-one percent of companies improved, while 53% declined.

- Over half of the companies that were in the 2012 and 2013 ratings earned lower scores this year.

- Eight companies showed double-digit increases: Humana, Old Navy, U.S. Bank, Citibank, TriCare, Blue Shield of California, Toyota, and Safeway.

- Twenty-one companies declined by at least 10 points and six companies dropped by more than 15 points: Southwest Airlines, MSN, United Airlines, ShopRite, Cablevision, and Bright House Networks.

Industry Results

Here are some industry highlights:

- Banks earned the highest average Temkin Web Experience Ratings, followed by investment firms, retailers, credit card issuers, and hotel chains.

- Five industries earned average ratings of “very weak” ratings: Internet service providers, TV service providers, airlines, health plans, and wireless carriers.

- Seven industries improved between 2012 and 2013., while nine declined. Airlines suffered the most dramatic drop, losing 15 points.

Calculating the Temkin Web Experience Ratings

During January 2013, Temkin Group asked 10,000 U.S. consumers to identify the companies that they had interacted with on their websites during the previous 60 days. These consumers were asked the following question:

Thinking back to your most recent interaction with the websites of these companies,

how satisfied were you with the experience?

Responses from 1= “very dissatisfied” to 7= “very satisfied”

For all companies with 100 or more consumer responses, we calculated the “net satisfaction” score. The Temkin Web Experience Ratings are calculated by taking the percentage of consumers that selected either “6” or “7” and subtracting the percentage of consumers that selected either “1,” “2,” or “3.”

Download entire dataset for $295

To see all of the companies in the Temkin Trust Ratings as ell as all of our other Temkin Ratings and sort through the results, visit the Temkin Ratings website

The bottom line: Web experiences are heading in the wrong direction.

Filed under 2013 Temkin Ratings, Customer experience

Tagged with 21st Century, 7-Eleven, A credit union, AAA, Ace Hardware, Acer, Activision, Adobe, Advance Auto Parts, Advantage, Aetna, AirTran Airways, ALamo, Alaska Airlines, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Ameriprise Financial, Anthem (BCBS), AOL, Apple, Apple Store, Arby's, AT&T, AutoZone, Avis, Bank Of America, Barnes & Noble, Bed Bath & Beyond, Best Buy, Best Western, BJs Wholesale Club, Blackboard, Blue Shield of California, BMW, Bosch, bright House Networks, Budget, Burger King, Cablevision, Capital One, CareFirst (BCBS), Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Continental Airlines, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta / Northwest Airlines, DirecTV, Discover, Dish Network / EchoStar, Dodge, Dollar, Dollar General, Domino's, Dunkin' Donuts, E*Trade, Earthlink, Edward Jones, Electrolux, eMachines, Empire BCBS, Enterprise, Fairfield Inn, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Ford, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Health Net, Hertz, Hewlett-Packard, Highmark BCBS, Hilton, Holiday Inn, Holiday Inn Express, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kroger, La Quinta, Lenovo, LG, Liberty Mutual, Little Caesar's, Marriott, McAfee, McDonalds, Med, Medicaid, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN (Microsoft Network), Nationwide, Nissan, Optimum (iO) / Cablevision, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quiznos, Qwest, Regions, Road Runner, S, Safeway, Samsung, Save-a-Lot, Scottrade, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Starbucks, State Farm, Stop & Shop, SunTrust Bank, Symantec, T-Mobile, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toyota, TracFone, Trader Joe's, Travelers, U.S. Bank, U.S. Cellular, U.S. Postal Service, United Airlines, UPS, US Airways, USAA, Verizon, Verizon Wireless, Virgin Mobile, Wells Fargo, Whirlpool, Whole Foods, Winn-Dixie

We just released the third annual Temkin Trust Ratings of 246 companies across 19 industries (see full list).

Download entire dataset for $295

Company Results

For the third straight year, USAA‘s insurance business earned the top ranking in the Temkin Trust Ratings. Here are additional highlights:

- Two of USAA’s business areas —insurance and banking—topped the list of companies. USAA’s credit card business also ranked sixth.

- The other companies in the top 10 of the ratings are credit unions, Publix, H.E.B., Amazon.com, Trader Joe’s, Charles Schwab, and Sam’s Club.

- HSBC earned two of the bottom three spots for its credit card and banking businesses.

- TV service providers and Internet service providers dominate the bottom of the ratings, collectively taking 10 of the bottom 15 spots. The other companies in the bottom 15 are US Airways, CareFirst, and T-Mobile.

We also examined year-over-year results for 204 companies that were also in the 2012 Temkin Trust Ratings. Here are some highlights of that analysis:

- Citigroup in credit cards and Hyundai earned the largest jump (21 points) over their 2012 Temkin Trust Ratings. The other largest gainers are Alaska Airlines, Bank of America in credit cards and banking, Continental Airlines, Avis, and EarthLink.

- Cox Communications in TV service and Fifth Third in banking lost the most ground (17 points) since last year. The other largest decliners are HSBC in banking, PNC in banking, JCPenney, Bright House Networks, and eMachines in computers.

Industry Results

Here are the highlights of the 19 industries in the 2013 Temkin Trust Ratings:

- Grocery chains earn the most trust while TV service providers earn the least trust from their customers.

- Six companies earned Temkin Trust Ratings that are 20 percentage points or more above their industry average: USAA (banking, credit cards, insurance carriers), credit unions (banking), TriCare (health plans), and Kaiser Permanente (health plans).

- Four companies earned Temkin Trust Ratings that are 20 percentage points or more below their industry average: HSBC (banking and credit cards), US Airways (airlines), 21st Century (insurance carriers).

- Led by credit card issuers and rental car agencies, 14 of the 18 industries in the 2012 and 2013 Temkin Trust Ratings improved over last year’s scores. The only four industries with declining ratings are TV service providers, retailers, appliance makers, and insurance carriers.

Calculating the Temkin Trust Ratings

During January 2013, Temkin Group asked consumers to identify companies that they have interacted with during the previous 60 days. For a random subset of those companies, consumers are asked to rate companies as follows:

To what degree do you TRUST that these companies will take care of your needs?

Responses from 1= “do not trust at all” to 7= “completely trust”

For all companies with 100 or more consumer responses, we calculated the “net trust” score. The Temkin Trust Ratings are calculated by taking the percentage of consumers that selected either “6” or “7” and subtracting the percentage of consumers that selected either “1,” “2,” or “3.”

Download entire dataset for $295

To see all of the companies in the Temkin Trust Ratings as ell as all of our other Temkin Ratings and sort through the results, visit the Temkin Ratings website

The bottom line: Without a customer’s trust, it’s hard to expect her loyalty.

Filed under 2013 Temkin Ratings, Customer experience

Tagged with 21st Century, 7-Eleven, A credit union, AAA, Ace Hardware, Acer, Activision, Adobe, Advance Auto Parts, Advantage, Aetna, AirTran Airways, ALamo, Alaska Airlines, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Ameriprise Financial, Anthem (BCBS), AOL, Apple, Apple Store, Arby's, AT&T, AutoZone, Avis, Bank Of America, Barnes & Noble, Bed Bath & Beyond, Best Buy, Best Western, BJs Wholesale Club, Blackboard, Blue Shield of California, BMW, Bosch, bright House Networks, Budget, Burger King, Cablevision, Capital One, CareFirst (BCBS), Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Continental Airlines, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta / Northwest Airlines, DirecTV, Discover, Dish Network / EchoStar, Dodge, Dollar, Dollar General, Domino's, Dunkin' Donuts, E*Trade, Earthlink, Edward Jones, Electrolux, eMachines, Empire BCBS, Enterprise, Fairfield Inn, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Ford, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Health Net, Hertz, Hewlett-Packard, Highmark BCBS, Hilton, Holiday Inn, Holiday Inn Express, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kroger, La Quinta, Lenovo, LG, Liberty Mutual, Little Caesar's, Marriott, McAfee, McDonalds, Med, Medicaid, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN (Microsoft Network), Nationwide, Nissan, Optimum (iO) / Cablevision, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quiznos, Qwest, Regions, Road Runner, S, Safeway, Samsung, Save-a-Lot, Scottrade, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Starbucks, State Farm, Stop & Shop, SunTrust Bank, Symantec, T-Mobile, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toyota, TracFone, Trader Joe's, Travelers, U.S. Bank, U.S. Cellular, U.S. Postal Service, United Airlines, UPS, US Airways, USAA, Verizon, Verizon Wireless, Virgin Mobile, Wells Fargo, Whirlpool, Whole Foods, Winn-Dixie

All companies, even customer experience leaders, make mistakes. But how much goodwill have companies built up for consumers to forgive them after those miscues? To answer this question, Temkin Group surveyed 10,000 U.S. consumers about companies with whom they’ve recently interacted. We used this data for the third annual Temkin Forgiveness Ratings of 246 companies across 19 industries.

Download entire dataset for $295

Company Results

Here are the highlights of the 246 companies in the 2013 Temkin Forgiveness Ratings:

- Advantage earns top spot. With an excellent score of 61%, Advantage earned the highest rating.

- USAA dominates forgiveness. USAA grabbed the next three spots for its banking, insurance, and credit card businesses.

- The rest of the top 10. H.E.B., Blackboard, Aldi, Alaska Airlines, credit unions and Publix round out the top 10

- No industry owns the top. The top 25 companies in the ratings comes form a variety of industries: Four grocery chains, three airlines, three retailers, two banks, two hotel chains, two investment firms, two software firms, one appliance maker, one auto dealer, one credit card issuer, one fast food chain, one health plan, one insurance carrier, and one rental car agency.

- HSBC dominates the bottom. HSBC earned the bottom two spots in the ratings for its credit card and banking businesses.

- Many TV service providers are at the bottom. Six of the bottom 12 companies are TV service providers: Cox Communications, Time Warner Cable, Comcast, Verizon, Charter Communications, and Optimum (iO)/Cablevision.

- USAA most outperforms its peers. We compared company ratings with their industry averages and USAA came in the top three spots, 36 points above in banking, 31 points ahead in credit cards, and 28 points ahead in insurance. Three other companies are more than 20 points above their industry averages: Advantage (car rentals), credit unions (banking), and TriCare (health plans).

- HSBC most underperforms. HSBC fell the farthest below its industry average in two areas, 23 points behind its peers in banking and credit cards. Five other companies had scores that were 15 points and more below their industry: US Airways (airlines), Motel 6 (hotels), McAfee (software), Kia (auto dealers), and Hertz (rental cars).

We also examined year-over-year results for 204 companies that were in both the 2012 and 2013 Temkin Forgiveness Ratings. Here are some highlights of that analysis:

- Chrysler improves the most. With a jump of 29 percentage points, Chrysler is the most improved company. Six other companies gained 20 points or more: Continental Airlines, Citigroup, Avis, EarthLink, Ameriprise Financial, and Alaska Airlines.

- US Cellular declines the most. With a drop of nearly 20 percentage points, US Cellular dropped the most in 2013. Nine other companies fell by more than 10 points: Bright House Networks, HSBC, Cox Communications, Hertz, PNC, SunTrust Bank, Dollar Rental Car, Hyatt, and TD Ameritrade.

Industry Results

Here are the highlights of the 19 industries in the 2013 Temkin Forgiveness Ratings:

- TV service providers are unforgivable. TV service providers, as an industry, earned the lowest Temkin Forgiveness Rating of 12%. It was five points below Internet service providers and seven points below wireless carriers.

- Grocery chains are the most forgivable. With an average rating of 39%, grocery chains are the highest scoring industry. Three industries are just four points behind: hotel chains, auto dealers, and rental car agencies.

- Credit cards make the most improvements. Credit cards made the largest improvement, nine percentage points, over the previous year. Auto dealers, rental car agencies, and airlines also improved by more than five points.

- TV service providers head in the wrong direction. Led by TV service providers that dropped three points between 2012 and 2013, three industries earned lower scores in 2012. The other industries are retailers and appliance makers.

Calculating the Temkin Forgiveness Ratings

During January 2013, Temkin Group asked consumers to identify companies that they have interacted with during the previous 60 days. For a random subset of those companies, consumers are asked to rate companies as follows:

How likely are you to forgive these companies if they deliver a bad experience?

Responses from 1= “extremely unlikely” to 7= “extremely likely”

For all companies with 100 or more consumer responses, we calculated the “net forgiveness” score. The Temkin Forgiveness Ratings are calculated by taking the percentage of consumers that selected either “6” or “7” and subtracting the percentage of consumers that selected either “1,” “2,” or “3.”

Download entire dataset for $295

To see all of the companies in the Temkin Forgiveness Ratings as ell as all of our other Temkin Ratings and sort through the results, visit the Temkin Ratings website

The bottom line: Forgiveness is an asset that you accumulate by consistently meeting customer needs.

Filed under 2013 Temkin Ratings, Customer experience

Tagged with 21st Century, 7-Eleven, A credit union, AAA, Ace Hardware, Acer, Activision, Adobe, Advance Auto Parts, Advantage, Aetna, AirTran Airways, ALamo, Alaska Airlines, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Ameriprise Financial, Anthem (BCBS), AOL, Apple, Apple Store, Arby's, AT&T, AutoZone, Avis, Bank Of America, Barnes & Noble, Bed Bath & Beyond, Best Buy, Best Western, BJs Wholesale Club, Blackboard, Blue Shield of California, BMW, Bosch, bright House Networks, Budget, Burger King, Cablevision, Capital One, CareFirst (BCBS), Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Continental Airlines, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta / Northwest Airlines, DirecTV, Discover, Dish Network / EchoStar, Dodge, Dollar, Dollar General, Domino's, Dunkin' Donuts, E*Trade, Earthlink, Edward Jones, Electrolux, eMachines, Empire BCBS, Enterprise, Fairfield Inn, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Ford, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Health Net, Hertz, Hewlett-Packard, Highmark BCBS, Hilton, Holiday Inn, Holiday Inn Express, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kroger, La Quinta, Lenovo, LG, Liberty Mutual, Little Caesar's, Marriott, McAfee, McDonalds, Med, Medicaid, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN (Microsoft Network), Nationwide, Nissan, Optimum (iO) / Cablevision, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quiznos, Qwest, Regions, Road Runner, S, Safeway, Samsung, Save-a-Lot, Scottrade, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Starbucks, State Farm, Stop & Shop, SunTrust Bank, Symantec, T-Mobile, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toyota, TracFone, Trader Joe's, Travelers, U.S. Bank, U.S. Cellular, U.S. Postal Service, United Airlines, UPS, US Airways, USAA, Verizon, Verizon Wireless, Virgin Mobile, Wells Fargo, Whirlpool, Whole Foods, Winn-Dixie

We published the 2013 Temkin Experience Ratings. The report analyzes feedback from 10,000 U.S. consumers to rate 246 organizations across 19 industries. Congratulations to the top firms in this year’s ratings: Publix, Trader Joe’s, Aldi, Chick-fil-A, Amazon.com, and Sam’s Club.

Download report for FREE

You can also download the data for $395.

You can also download the data for $395.

The Temkin Experience Ratings are based on evaluating three elements of experience:

- Functional: How well do experiences meet customers’ needs?

- Accessible: How easy is it for customers to do what they want to do?

- Emotional: How do customers feel about the experiences?

Here are the top and bottom companies in the ratings:

Here’s how the industries compare with each other:

Here’s how the industries compare with each other:

(NOTE: We have published posts on the detailed results for all 19 industries)

Here are the companies that are leaders and laggards across the 19 industries:

Here are the companies that are leaders and laggards across the 19 industries:

In this year’s ratings, 37% of companies earned “good” or “excellent” scores, while 28% are rated as “poor” or ”very poor.” Companies with at least a “good” rating grew by nine-percentage points since 2012 and by 21-points since 2011. Of the 203 companies that are included in both the 2012 and 2013 Temkin Experience Ratings, 57% firms had at least a modest increase. The companies that made the largest improvement over 2012 are Citibank, TriCare, TD Ameritrade, Office Depot, EarthLink, Hardees, and Regions Bank.

Download report for FREE

Get the Data

Do you want to see all of the data? You can purchase an excel spreadsheet for $395…

To view all of our ratings (experience, loyalty, trust, forgiveness, customer service, and web experience), visit the Temkin Ratings website…

The bottom line: Customer experience is improving, but there’s still a long way to go

Filed under 2013 Temkin Ratings, Benchmarks, Temkin Group Research, Trends

Tagged with AAA, Ace Hardware, Adobe, Advance Auto Parts, AirTran Airways, ALamo, Alaska Airlines, Aldi, Allstate, Amazon.com, American Airlines, American Family, Ameriprise Financial, Anthem (BCBS), Apple, Apple Store, AT&T, AutoZone, Avis, Bank Of America, Barnes & Noble, Bed Bath & Beyond, Best Buy, BJs Wholesale Club, Blackboard, Blue Shield of California, Bright House, Budget, Burger King, Cablevision, Capital One, CareFirst (BCBS), Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Chrysler, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Continental Airlines, Costco, Courtyard By Marriott, Coventry Health Care, Cox Communications, Crowne Plaza, CVS, Dairy Queen, Days Inn, Dell, Delta Airlines, DirecTV, Discover, DISH Network/EchoStar, Dodge, Dollar, Dollar General, Dollar Tree, Domino's, Dunkin' Donuts, E*Trade, Earthlink, eBay, Edward Jones, Electrolux, eMachines, Empire BCBS, Enterprise, Fairfield Inn, Family Dollar, Farmers, Fidelity Investments, Fifth Third, Food Lion, Ford, GameStop, Gap, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Health Net, Hertz Acer, Hewlett-Packard, Highmark BCBS, Hilton, Holiday Inn, Holiday Inn Express, Home Depot, Honda, HSBC, Humana, Hy-Vee, Hyatt, Hyundai, ING Direct, Intuit, Jack in the Box, JCPenney, JetBlue Airlines, Kaiser Permanente, KFC, Kia, Kmart, Kohl's, Kroger, La Quinta, Lenovo, LG, Liberty Mutual, Little Caesar's, Lowe's, Macy's, Marriott, Marshalls, McAfee, McDonalds, Medicaid, Medicare, Merrill Lynch, MetLife, MetroPCS, Microsoft, Morgan Stanley Smith Barney, Motel 6, MSN, Nationwide, Nissan, Nordstrom, O'Reilly Auto Parts, Office Depot, OfficeMax, Old Navy, Optimum (iO)/Cablevision, PetSmart, Piggly Wiggly, Pizza Hut, PNC, Progressive, Publix, Quality Inn 21st Century, Quiznos, QVC, Qwest, RadioShack, Regions, Rite Aid, Road Runner, Ross, Safeway, Sam Club, Samsung, Save-a-Lot, Scottrade, Sears, ShopRIte, Sonic Drive-In, Sony, Southwest Airlines, Sprint, Staples, Starbucks, State Farm, Stop & Shop, Subway, SunTrust Bank, Symantec AT&T, T.J. Maxx, Taco Bell, Target, TD Ameritrade, TD Bank, The Hartford, Time Warner Cable, Toshiba, Toshiba American Express, Toyota Credit unions, Toys "R" Us, TracFone, Trader Joe's, Travelers, TriCare, True Value, U.S. Bank, U.S. Cellular, U.S. Postal Service, United Airlines, United Healthcare Best Western, UPS 7-Eleven, US Airways BMW, USAA, USAA AOL, Vanguard, Verizon A credit union, Verizon AT&T, Verizon Wireless, Virgin Mobile, Wal-Mart, Walgreens Activision, Wells Fargo Advantage, Wells Fargo Advisors Bosch, Wells Fargo Arby's, Wendy’s Albertsons, Whirlpool FedEx, Whole Foods, Winn-Dixie Aetna

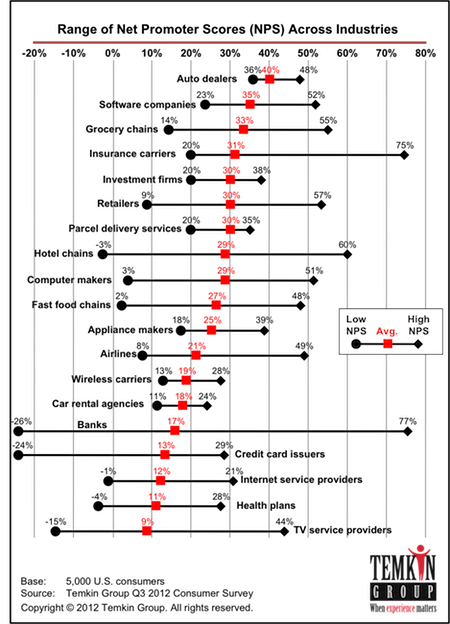

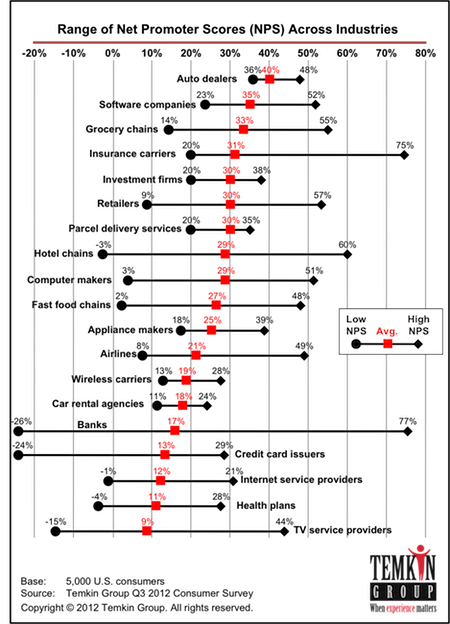

We just published a Temkin Group report, Net Promoter Score Benchmark Study, 2012. It provides NPS data on 175 U.S. companies across 19 industries. Here’s the executive summary:

We just published a Temkin Group report, Net Promoter Score Benchmark Study, 2012. It provides NPS data on 175 U.S. companies across 19 industries. Here’s the executive summary:

USAA took the top two spots for its banking and insurance businesses while HSBC came in at the bottom for banking and credit cards. Our analysis of differences across consumer demographic segments showed that NPS tends to go up with age, doesn’t vary much by income levels, and is often highest with Asians. We also asked consumers what would make them more likely to recommend the companies and found that promoters are more likely to select lower prices and detractors are more likely to select better customer service. While there is some debate about the efficacy of NPS, our analysis shows that promoters are much more likely than detractors to purchase more in the future across all industries. To help you implement a successful NPS program, we’ve included eight tips such as don’t believe in an “ultimate question” and use control charts, not pinpointed goals. The industries included in this report are airlines, auto dealers, banks, computer makers, credit card issuers, fast food chains, grocery chains, health plans, hotel chains, insurance carriers, Internet service providers, investment firms, major appliance makers, parcel delivery services, rental car agencies, retailers, software firms, TV service providers, and wireless carriers.

Download report for $295

(includes the data)

The industries included in this report are airlines, auto dealers, banks, computer makers, credit card issuers, fast food chains, grocery chains, health plans, hotel chains, insurance carriers, Internet service providers, investment firms, major appliance makers, parcel delivery services, rental car agencies, retailers, software firms, TV service providers, and wireless carriers.

The report contains the following components:

- NPS for 175 companies across 19 industries

- NPS differences based on age, income, and ethnicity of consumers

- Improvement areas selected by promoters and detractors by industry

- Connection between NPS and future purchases by industry

- Eight tips for implementing a successful NPS program

Download report for $295

(Includes the data)

The bottom line: Companies need to give customers a reason to recommend them

Filed under Benchmarks, Customer Connectedness, Customer experience, Net Promoter, Temkin Group Research, Voice of the customer

Tagged with A credit union, AAA, Acer, Adobe, Aetna, Albertsons, Aldi, Allstate, Amazon.com, American Airlines, American Express, American Family, Anthem (BCBS), AOL, Apple, Arby's, AT&T, Bank Of America, Barnes & Noble, Baskin Robbins, Best Buy, Best Western, BJs Wholesale Club, Blue Shield of California, BMW, Bright House, Budget, Burger King, Cablevision, Cadillac, Capital One, Charles Schwab, Charter Communications, Chase, Chevrolet, Chick-fil-A, Cigna, Citibank, Citigroup, Citizens, Comcast, Comfort Inn, Compaq, Costco, Courtyard By Marriott, Cox Communications, CVS, Dairy Queen, Days Inn, Dell, Delta/Northwest Airlines, DHL, DirecTV, Discover, DISH Network/EchoStar, Dollar, Domino's, Dunkin' Donuts, E*Trade, eBay, Enterprise, Farmers, FedEx, Fidelity Investments, Fifth Third, Food Lion, Ford, Gap, Gateway, GE, Geico, Giant Eagle, Google, H.E.B, Hampton Inn, Hardees, Hertz, Hewlett-Packard, Hilton, Holiday Inn, Holiday Inn Express, Home Depot, Honda, HSBC, Humana, ING Direct, Jack in the Box, JCPenney, JetBlue Airlines, Kaiser Permanente, KFC, Kmart, Kohl's, Kroger, LG, Little Caesar's, Lowe's, Macy's, Marriott, McAfee, McDonalds, Medicaid, Medicare, Merrill Lynch, Microsoft, Motel 6, Nationwide, Nissan, Office Depot, OfficeMax, Old Navy, Pizza Hut, PNC, Progressive, Publix, Quiznos, QVC, Qwest, RadioShack, Regions, Rite Aid, Road Runner, Safeway, Sam's Club, Samsung, Save-a-Lot, Sears, ShopRIte, Sonic Drive-In, Southwest Airlines, Sprint, Staples, Starbucks, State Farm, Stop & Shop, Subway, SunTrust Bank, T-Mobile, Taco Bell, Target, TD Bank, Time Warner Cable, Toshiba, Toyota, Toys "R" Us, TracFone, TriCare, United Airlines, United Healthcare, UPS, US Bancorp, US Postal Service, USAA, Verizon, Verizon Wireless, Virgin Mobile, Wal-Mart, Walgreens, Wells Fargo, Wells Fargo Advisors, Wendy's, Whirlpool, Whole Foods, Winn-Dixie

I read an interesting article in the New York Times: Bank Analyst Sees No Payoff in a Customer-Friendly Focus. It discusses how bank industry analyst Richard X. Bove believes that focussing on customers may be harmful for banks because it distracts them from making money. Here’s a bit of what he said:

Spending time solving problems with people is not selling products. It’s wasting time.

My take: First of all, I think that Bove is partially right. If you don’t have good products or if you don’t have solid sales processes, then you probably won’t have good business results; customer experience is not good enough on its own. As I’ve said for many years, customer experience is not a standalone activity, it needs to support your brand and business strategy.

Having said that, our research shows that companies with better customer experience have a better opportunity to improve their business results. That relationship holds up in our research across many industries.

I decided to take a look at one dimension of the Temkin Experience Ratings (easiness of doing business) and one dimension from the Temkin Loyalty Ratings (willingness to consider for another purchase) in banking. Here’s how those CX and loyalty items line up for 16 banks.

As you can see, there’s a high correlation between CX and potential loyalty. Just because 74% of USAA’s members are likely to consider the financial institution for another purchase, they aren’t going to do it unless USAA offers them an appropriate and competitive product.

As you can see, there’s a high correlation between CX and potential loyalty. Just because 74% of USAA’s members are likely to consider the financial institution for another purchase, they aren’t going to do it unless USAA offers them an appropriate and competitive product.

The bottom line: CX is valuable, but not enough on its own

Filed under Customer experience, ROI of Customer Experience

Tagged with Bank Of America, Capital One, Chase, Citibank, Citizens, credit unions, Fifth Third, HSBC, ING Direct, PNC, Regions, Richard X. Bove, SunTrust Bank, TD Bank, US Bancorp, USAA, Wells Fargo

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.

We recently released the 2017 Temkin Experience Ratings that ranks the customer experience of 331 companies across 20 industries based on a survey of 10,000 U.S. consumers.