Business-to-Business-to-Customer (B2B2C) CX Best Practices

November 21, 2016 1 Comment

We often get asked by companies that don’t directly serve consumers if they can learn from customer experience content that seems to be more focused on business-to-consumer (B2C) models. The answer: Absolutely yes!

Our research does include some items that are B2C-oriented, but most of our core ideas apply quite well in other models, including business-to-business (B2B), government and non-profits. We’ve had no problem using our insights to help a wide range of organizations.

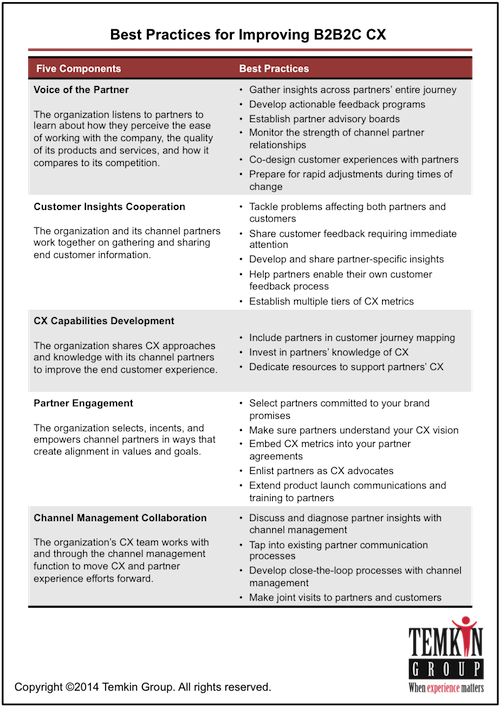

In our report The Secret to B2B2C Customer Experience Success, we discuss a more complex B2B model, business-to-business-to-customer (B2B2C). The goal of CX in B2B2C is to:

Enhance end customer experience in a way that satisfies the needs of channel partners

B2B2C CX is all about four relationships:

- Company to Channel Partners. To deliver great CX to customers, a company also needs to nurture its relationships with its channel partners to help them be successful.

- Channel Partners to End Customer. In this relationship, a company can only influence how channel partners think about and deliver CX in the partner’s interactions with the end customer.

- Company to End Customer. These interactions provide the company with the best CX opportunities to deliver great CX to the end customer because such interactions are wholly under a company’s control.

- Company and Channel Partner to End Customer. These are times when a company and a channel partner engage the end customer as one unit. In these instances, both partners need to share a common vision of how the CX should be delivered.

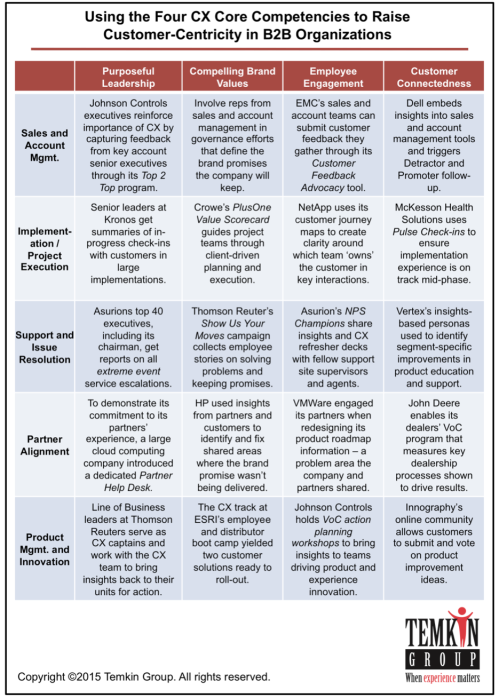

In the chart below, you can see how to infuse these four CX core competencies across the relationships:

In the chart below, you can see how to infuse these four CX core competencies across the relationships:

- Purposeful Leadership: Operate consistently with a clear set of values.

- Employee Engagement: Align employees with the goals of the organization.

- Compelling Brand Values: Deliver on your brand promises to customers.

- Customer Connectedness: Infuse customer insight across the organization.

The bottom line: Good CX practices transcend business models.