Report: 2013 Temkin Experience Ratings of Tech Vendors

July 24, 2013 4 Comments

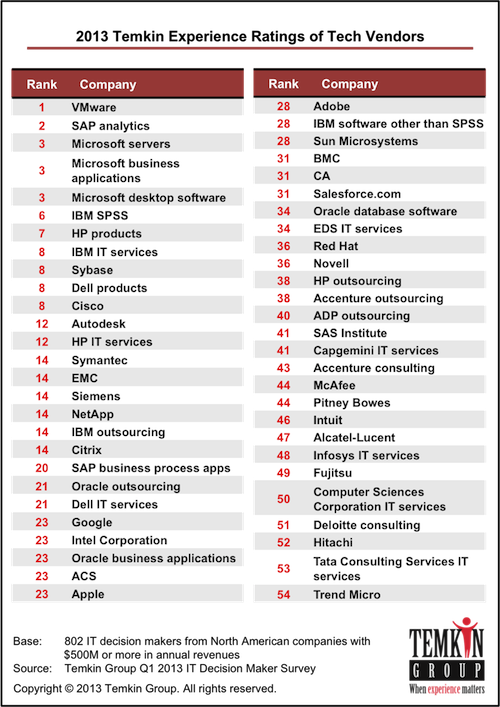

We just published a Temkin Group report 2013 Temkin Experience Ratings of Tech Vendors that rates the customer experience of 54 large tech vendors based on a survey of 802 IT decision makers form large North American firms. Here is the executive summary of the report:

We just published a Temkin Group report 2013 Temkin Experience Ratings of Tech Vendors that rates the customer experience of 54 large tech vendors based on a survey of 802 IT decision makers form large North American firms. Here is the executive summary of the report:

The 2013 Temkin Experience Ratings for Tech Vendors rates 54 large IT suppliers. We surveyed 800 IT professionals from large companies on the functional, accessible, and emotional components of their experiences with the IT providers. VMware, SAP analytics, and Microsoft (for servers, business applications, and desktop software) were at the top of the list with “excellent” ratings. At the other end of the spectrum, Hitachi, Tata, and Trend Micro were at the bottom of the list with “very poor” ratings. Our research also shows that the Temkin Experience Ratings are highly correlated with purchase momentum and innovation equity for these 54 firms. We show that Oracle outsourcing, VMware, NetApp, and SAP analytics have the most purchase momentum while Pitney Bowes, Trend Micro, and Deloitte consulting have the least. When it comes to innovation equity (the willingness of customers to try new offerings), VMware, SAP analytics, IBM SPSS, and Apple are at the top of the list and Accenture consulting, Intuit, and Deloitte consulting are at the bottom.

Download report for $495 (includes data file in Excel)

![]()

The Temkin Experience Ratings for Tech Vendors evaluates three areas of customer experience: functional (can customers achieve what they want to do), accessible (how easy is it for customers to do what they want to do), and emotional (how do customers feel about their interaction). Here are the overall results:

Here are some of the findings from the research:

- Only one tech vendor, VMware, earned an “excellent” rating while 17 earned “very poor” ratings.

- The average Temkin Experience Ratings for Tech Vendors has dropped from 58 percent in 2012 year to 52 percent this year, with the largest decline in the functional component.

- Oracle’s outsourcing services has the highest purchase momentum, followed by VMware, NetApp, and SAP analytics. At the bottom of the list for purchase momentum are Pitney Bowes, Trend Micro, and Deloitte consulting.

- VMware has the highest innovation equity, followed by SAP analytics, IBM SPSS, and Apple. At the bottom of the list, six tech vendors have innovation equity scores below 30 percent: Accenture consulting, Intuit, Deloitte consulting, Alcatel-Lucent, Pitney Bowes, and Infosys IT services.

- As you can see in the chart below, the Temkin Experience Ratings are highly correlated to purchasing momentum (plans of customers to purchase more in 2013) and innovation equity (the willingness of customers to try new offerings)

Download report for $495 (includes data file in Excel)

![]()

The bottom line: Tech vendors need to improve their customer experience

Hi Bruce – wondering why Infor were not reported on? I’m sure there could be a lot of reasons and genuinely just inquiring why – I guess with a view to perhaps getting us included next time.

Regards,

[Description: Infor]

Peter J. Quinn – VP & Chief Customer Officer

mobile: +1 630 842 3378

peter.quinn@infor.com | http://www.infor.com

Hi Peter: Infor was in our dataset, but we did not get enough respondents to report on it.

Were there any Kronos respondents in your dataset?

Joyce: We did not ask about Kronos.