Walmart’s Pay Increase Will Probably Lower Costs

June 11, 2015 Leave a comment

Walmart recently announced that it plans to raise wages for more than 100,000 of its managers and employees in specialized departments. Why would the “everyday low prices” retailer add a ton of new costs to its ongoing operations?

I want to explore a hypothesis that this move will actually lower Walmart’s long-term costs. I know it sounds counter-intuitive; how do you lower costs by spending more? The answer comes from understanding the Employee Engagement Virtuous Cycle.

As you can see, a more engaged workforce can drive even better financial results. One of the reasons is that engaged employees are much more productive, they’re willing to work harder. While compensation is not the key motivator for engaging employees, it’s hard to engage employees who don’t believe that they are being fairly compensated.

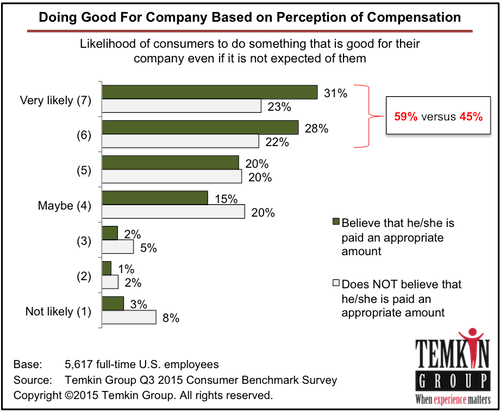

As you can see below, 59% of employees who believe they are appropriately compensated are highly likely to do something good for the company even if it’s not expected of them, compared with 45% of employees who do not believe they are appropriately compensated.

This move by Walmart will certainly get a lot more employees to believe that they are appropriately compensated. Think about how much value (and cost savings) those employees can create by doing good things for Walmart. I’d bet that it will more than cover the costs of the pay raises.

The bottom line: Sometimes you can save money by paying your employees more.

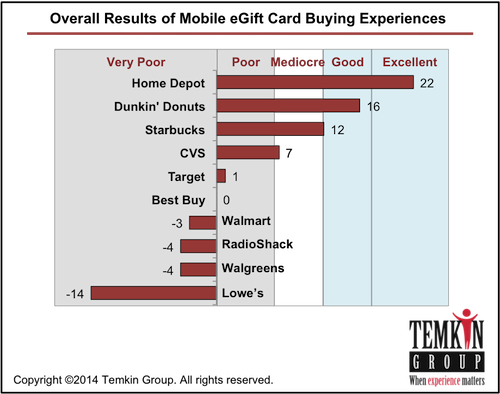

Since many consumers are flocking to retailers at this time of year, I decided to share some details of the 27 retailers in the 2011 TER. The chart below shows the overall TER (across all 143 companies) as well as where the retailers rank compared to each other in the functional, accessible, and emotional elements of experience.

Since many consumers are flocking to retailers at this time of year, I decided to share some details of the 27 retailers in the 2011 TER. The chart below shows the overall TER (across all 143 companies) as well as where the retailers rank compared to each other in the functional, accessible, and emotional elements of experience.